Amortization app for iPhone and iPad

Developer: Business Compass LLC

First release : 19 Jul 2010

App size: 3.2 Mb

This super-fast application amortizes loan over the term of the loan. This is a flexible application applicable to most consumer loans. After loan input is supplied, move over to summary to see the loan summary and detail to see amortization schedule.

Print and e-mail summary and schedule.

Summary and amortization schedule appears at lightening speed with easy to understand graphs and charts!

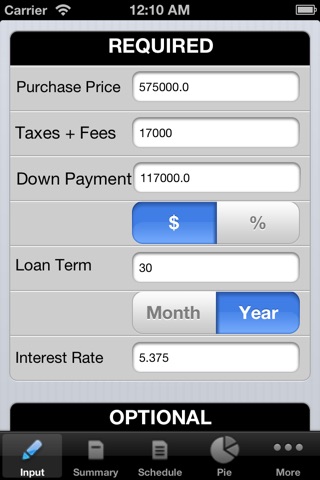

Input:

1. Purchase price

2. Taxes and fees (optional)

3. Down payment (optional) - can be specified as % of principle or as a dollar amount

4. Loan term in Months/Years. By default loan term is in months.

5. Interest rate in APR

6. Number of payments/year (optional). By default, it is 12/year.

7. Extra payment per period (optional)

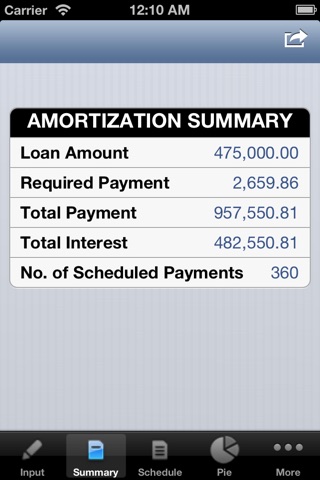

Summary:

1. Loan Balance

2. Required payment per period

3. Total interest paid

4. Total payment made

5. Number of scheduled payments

6. Number of actual payments

7. Reduction of payment term in years and months

8. Total early payments

9. Total savings

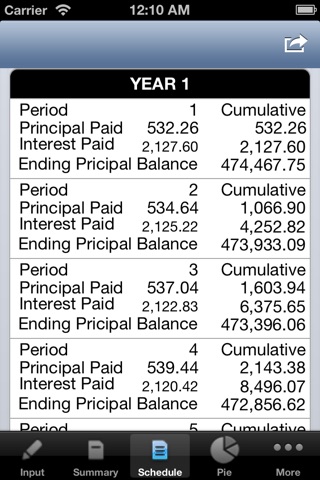

Amortization Schedule

1. Period

2. Interest paid

3. Principle paid

4. Cumulative interest paid

5. Cumulative principle paid

6. Ending principle balance

Graphs & Charts

1. Pie chart to display principle vs. interest

2. Line chart to show cumulative payment, interest and principle paid over time

Print & E-Mail:

1. Print summary and schedule as formatted tables

2. E-mail summary and schedule as formatted PDF attachment

Data Storage & Retrieval

1. Data is saved and retrieved when application is re-started